Two objectives of hydrogen rollout

On the one hand, deploying renewable energy sources is essential to achieve net-zero targets. Grid stability must be maintained throughout their rollout, requiring demand to adapt to natural intermittency and availability of renewable energy. Without sufficient flexible assets, the efficient addition of renewables becomes constrained: peak generation cannot be safely transmitted by the grid without matching demand, which leads to curtailment, negative prices, and an unattractive business case for renewables.

On the other hand, there is strong motivation to maximise hydrogen production. Firstly, high capital expenditures (CapEx) require high revenues to recoup investments. Secondly, offtakers require stable hydrogen production to feed downstream processes and meet high consumption targets. This perspective stands at odds with electrolysis as a flexible demand provider. So, the question is: can the two objectives be combined?

Regulation and grid perspective

In the case of the Netherlands, the spot market comprises day-ahead and intraday markets, with prices determined by supply and demand dynamics. The local system operator, TenneT, ensures the balance between electricity supply and demand, procuring flexible resources for load adjustments through various mechanisms. Asset flexibility – the ability to quickly adjust load up or down – is crucial for managing supply and demand fluctuations, leading to more stable prices and system security.

Therefore, power-to-gas, specifically through electrolysis, holds significant potential in the energy sector as a provider of such flexibility. Electrolysers can indeed consume power during periods of high renewable generation and minimise consumption when power is scarce, playing a key role in surplus utilisation and preventing negative prices. Flexible operation combined with market optimisation contributes to balancing the grid, facilitating the rollout of renewable sources and enhancing the financial performance of hydrogen projects.

Flexible operation of electrolysers is also supported by European legislation, such as the Renewable Energy Directives (RED) and its Delegated Act, which state that to be considered green, hydrogen must follow temporal (hourly after 2030) correlation with renewable generation.

TenneT’s Adequacy Outlook explores the resources needed in a net-zero carbon emission energy system. The outlook assumes 50 gigawatts of electrolyser installed capacity with an average load of approximately 20%, far from round-the-clock utilisation. Hydrogen projects are not expected to be major grid service providers but can benefit from them by lowering energy costs and adding new revenue streams.

From the regulation and grid perspective, electrolysers are needed as providers of flexible demand to reduce the imbalance between intermittent renewables and fixed demand for electricity.

Project development perspective

The hydrogen value chain is gradually being implemented with projects of increasing scale, focusing on green hydrogen production and delivery to industry and mobility. Developers face numerous barriers, including high hydrogen production costs, limited willingness to pay a green premium from hydrogen offtakers, and inflexible offtake requirements from the industry. These challenges are typically addressed with high load hours and limited flexibility, contradicting the requirements of the system operator, as mentioned above.

To address the high cost of hydrogen production, power purchase agreements (PPAs) are commonly used, fixing the electricity price and spreading the CapEx over many hours of production. Subsidies equally play a significant role in offsetting CapEx, but they often require compliance with regulation, which demands that renewable energy is additional, temporally and geographically correlated with hydrogen production.

Some offtakers require minimum volumes to be delivered, setting a daily or weekly goal for hydrogen production. A minimum of operating hours is usually set at 4,000–5,000 per year, translating to 45–60% utilisation. Such operation stands at odds with the interests of the grid.

Hydrogen consumption perspective

A number of industries need hydrogen molecules to decarbonise. The European Union’s target for 42% renewable industrial hydrogen consumption by 2030 presents a significant challenge for the Netherlands, which has the highest per capita hydrogen consumption globally. It is also an opportunity to lead the transition and build a system worth replicating by other countries. This system can rely on two options for sourcing renewable hydrogen: production and import.

Production of green hydrogen under the RED requires supply from intermittent renewable energy sources. In the absence of green energy, electrolysers can produce grey hydrogen, but this is neither environmentally nor economically efficient. A variable operation of electrolysers results in a variable hydrogen supply against continuous demand, creating a difficult market structure.

While some offtakers can accommodate intermittent supply, electrolysers alone may not suffice. To meet continuous demand within a stable energy market, two strategies can be employed: combining local production with import and investing in storage and pipeline infrastructure.

Case study

To understand the value of flexibility and its impact on the system, we modelled a hydrogen project under different interventions related to operation, hydrogen price and offtake, energy procurement, and financial aid in the context of the green hydrogen economy in the Netherlands.

Our techno-economic model simulates the optimal operation of an electrolyser and calculates project metrics. Technical inputs include energy intake from renewable assets and energy markets with price and volume profiles, parameters of the electrolysis process, and hydrogen offtake requirements. Financial inputs include costs associated with building and operating the plant, grid costs, hydrogen prices, and the interest rate.

The model optimises electricity purchasing strategy (combining PPAs with participation in day-ahead and intraday markets, as well as passive imbalance) and electrolyser operation to maximise daily gross margin. This is done by deciding how much electricity to buy and how to split it between production and reselling. The outputs are aggregated to calculate the Net Present Value (NPV) and Levelized Cost of Hydrogen (LCOH) for the project.

The model is an approximate representation of reality and contains simplified assumptions, such as fixed system efficiency and limited number of states (no stand-by or cold starts). Additionally, the model assumes perfect price and generation foresight, which is not realistic for intraday and imbalance markets.

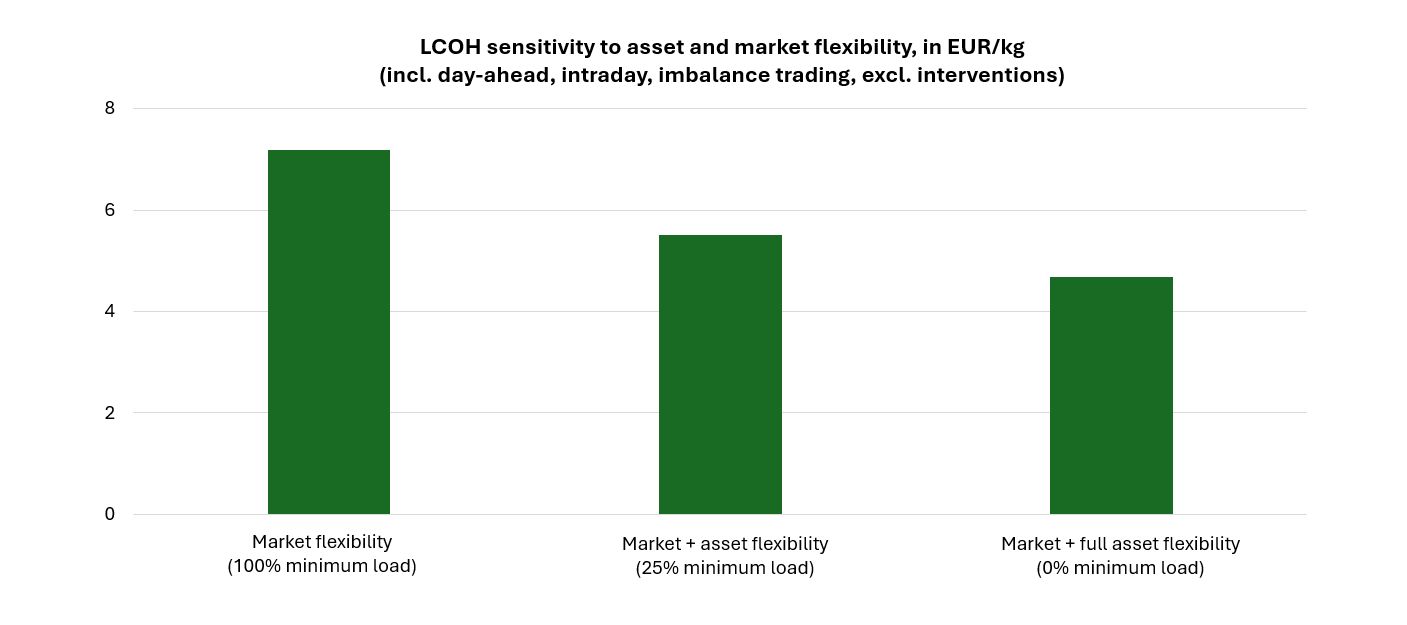

The case study investigates an alkaline electrolyser of 10 MW directly connected to a 20-MW mix of wind and solar assets of equal capacity, as well as the grid. The oversized renewable sources generate enough electricity to assume 100% green hydrogen production under monthly temporal correlation. The cost of this electricity is assumed to be determined by day-ahead prices, which is a possible pricing strategy for subsidised renewable assets. To test the full flexibility range, inflexible (100% minimum load), base case (25%), and flexible (0%) electrolysers are modelled with one market (day-ahead) and three markets (day-ahead, intraday, passive imbalance).

Results

We found that electrolyser flexibility and smart energy trading alone can make the business case over 50% more viable compared to operating 24/7.

While subsidies and interventions are still required to break even, fully flexible electrolysers can become profitable with almost 25% lower green hydrogen premiums or 50% lower CapEx subsidies and will be less affected by the hourly correlation requirement. They can provide 10–30% lower LCOH compared to electrolysers with baseload requirements (see Figure 1).

Value of flexibility

Electrolyser operators can reduce energy costs by producing hydrogen when prices are low, turning down to minimum load when prices are high, and using the remaining capacity as coverage in trading electricity on multiple markets.

Asset flexibility can be leveraged to improve profitability, with up to 60% increase of NPV compared to round-the-clock operation. Energy market optimisation can further increase profits for flexible assets, with up to 44% improvement in NPV compared to using a single market. Next, different interventions are tested in isolation and compared to the market-optimised case.

Hydrogen price

Hydrogen price can be influenced by consumer willingness to pay, taxes, or subsidies such as the European Hydrogen Bank’s fixed premium per kilogram of green hydrogen. Inflexible electrolysers have a linear relationship with hydrogen price as they do not change the operation, while flexible ones show non-linear sensitivity, as higher hydrogen prices result in higher utilisation. The same hydrogen price interventions benefit less flexible electrolysers more, but more flexible electrolysers need lower prices to break even than less flexible electrolysers.

Renewable Energy Directive (RED)

As mentioned, green hydrogen production requires renewable energy, which can be sourced through behind-the-meter generation or PPAs. The RED outlines criteria for PPAs, including additional renewable installations and simultaneous production and consumption of renewable electricity with monthly correlation until 2030 and hourly correlation thereafter. We also found that the hourly correlation scheme decreases NPV compared to the monthly correlation for all electrolysers, but has less impact on flexible electrolysers. Highly flexible electrolysers need lower premiums to break even, at 3.92 EUR/kg in our case

CapEx

Reducing upfront costs with CapEx subsidies like the Dutch OWE can make hydrogen production more viable. CapEx impacts NPV linearly regardless of flexibility, but only the flexible electrolyser in our study breaks even with just a CapEx subsidy (78%), while the others need subsidies exceeding the initial investment.

Hydrogen price vs CapEx interventions

To reach NPV=0 in the fully flexible case, either a 3.92 EUR/kg premium for green hydrogen or a 78% CapEx subsidy is needed. We compared these subsidy schemes in terms of cost, offtake, and grid utilisation to understand systemic impact. The CapEx subsidy is more efficient per 1 EUR spent, but the hydrogen subsidy doubles hydrogen production and full load hours, benefiting offtakers and reducing grid utilisation during peak hours.

Offtake

Running the electrolyser 24/7 with fluctuating energy prices negatively impacts the business case compared to flexible operation. But even in flexible cases, high hydrogen output requirements can lead to production during unprofitable periods. With a minimum load of 25%, the base case electrolyser already operates for at least 2,190 hours per year. A flexible electrolyser can optimise production by selecting hours with the lowest prices, producing the same amount with 25% better NPV. The benefit of flexibility diminishes as the offtake requirement increases.

Combined interventions

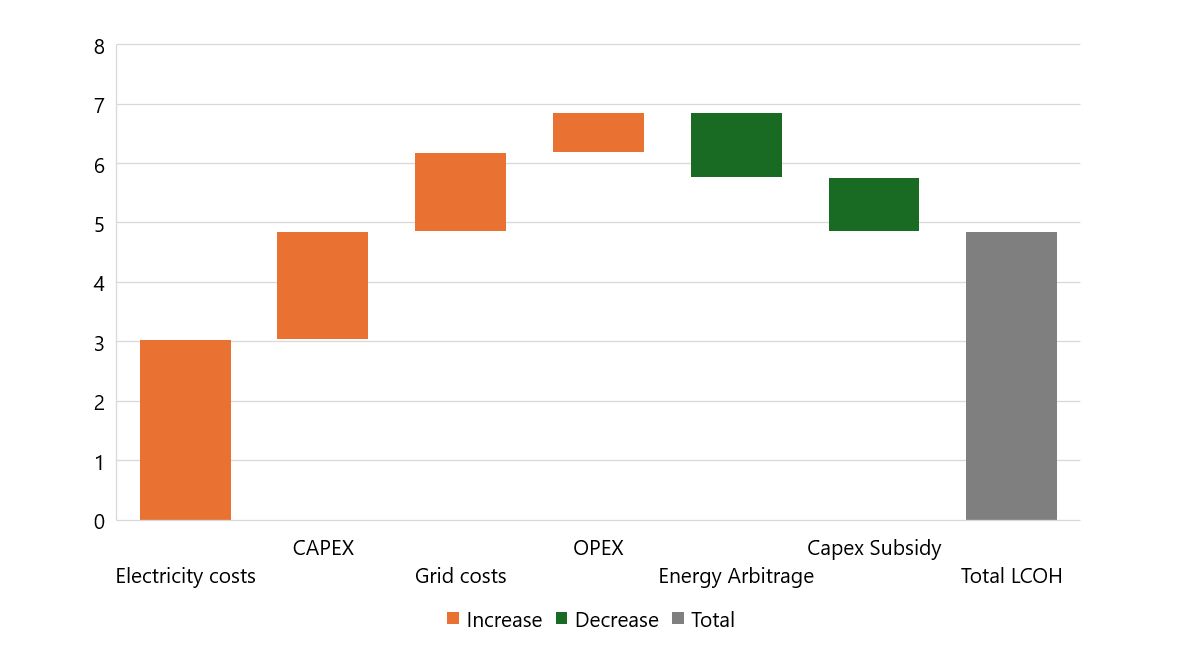

We applied a mix of interventions for a more realistic case: PPA scheme with hourly correlation, minimum offtake requirement of 2,540 kg/day (equivalent to 5,000 full load hours per year), green price premium of 3.5 EUR/kg, and a 50% CapEx subsidy.

Flexibility provides the same amount of hydrogen with a better business case and lower LCOH than baseload production. The LCOH improves by 20% in the base case and 30% in the fully flexible case. The breakdown for the base case (25% minimum load) LCOH is shown in Figure 2, with electricity constituting the highest portion, followed by CapEx and grid cost. Arbitrage profit decreases LCOH more than the CapEx subsidy.

Other considerations

While based on the current regulatory and market landscape in the Netherlands, this study serves as a proxy for projects in North-Western Europe. It focuses on the economic aspects of hydrogen production excluding safety, operational, and transportation concerns. In practice, many electrolyser technologies cannot safely operate at low minimum loads or need market strategies to account for ramp-up and ramp-down rates.

It represents small electrolysers typical for pilot projects before 2030, crucial for paving the way for larger ones. Future projects are expected to have lower CapEx due to technology advancements and economies of scale. The study explores variable-price PPAs, feasible for subsidised renewables, but future projects will likely use unsubsidised sources with fixed price agreements. However, even in these setups, flexibility and access to energy markets offer a wider decision space, and therefore higher potential to lower energy costs.

For this to happen, government intervention is needed to bridge the cost gap to grey hydrogen. A regulatory framework aligned with subsidies is required to incentivise flexibility and enable appropriate infrastructure for import, storage, and transport, such as the fast deployment of the hydrogen backbone for a constant hydrogen supply.

With sufficient hydrogen infrastructure, electrolyser flexibility could be taken even further: not as a way to improve hydrogen project profitability, but as a standalone business case with the purpose of grid balancing and facilitating renewable energy rollout. It would use inexpensive surplus energy and balancing services and produce hydrogen as a by-product. This case, however, assumes there is value in curtailed energy and that providing intermittent demand for it would benefit the system.

For more details on the study, see: https://www.battolysersystems.com/white-paper.

About Battolyser Systems

Battolyser Systems is a cleantech scale-up that develops and manufactures an electrolyser with battery capacity, the Battolyser®. When there is lots of solar or wind power, a Battolyser can convert electricity to green hydrogen, and when there is not enough, it can give renewable energy back to the grid. A Battolyser enables renewable energy system integration and ‘unlocks 100% green hydrogen’ using only abundant and sustainable materials.