By Jamie Frew

Fast-forward to now and everyone and their auntie is talking about hydrogen, a massive autothermal reformer here, a few gigawatts there. Hydrogen is hot, and on any day, we may see several authoritative 100-page reports from specialist consultancies launched, extolling the economic virtue of one supply chain over another. According to some studies, the cost of renewable hydrogen is anywhere between two and ten times that of fossil hydrogen. Yet other reports show us that green hydrogen produced in faraway renewables hotspots will be almost as cheap as the water it is made from. Whom should we believe? The (as always unsatisfactory) answer is: it depends.

To even start the economic comparison, we need a few key pieces of information. By far the most important element is the energy price assumption. However, when we look at the public discourse, we see that many compare technologies, present graphs, and promote projects without even mentioning this most critical assumption. As a ballpark figure, energy makes up about 80% of the cost of hydrogen, so it is by far the most critical driver of the levelized cost of hydrogen (LCOH). However, it is not hard to find a study where energy prices are either not mentioned or are buried in the back pages of the appendices like some dirty secret. These numbers should be front and centre as good general understanding of how the LCOH is constructed is crucial to making the right choices in the energy transition.

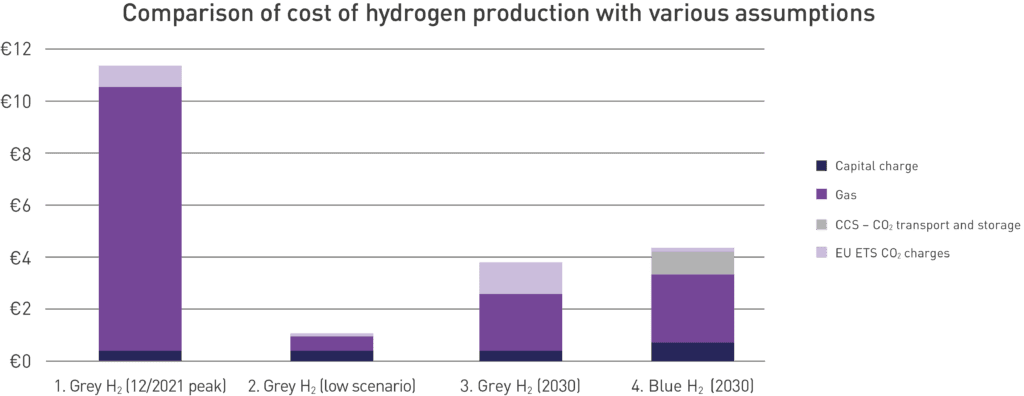

Recently, I have seen many commentators boldly state: “green hydrogen is still too expensive,” or “green hydrogen is six times the cost of grey”. All this whilst in 2021, the actual costs of grey hydrogen production have climbed like a tech billionaire’s rocket due to the ongoing gas price commodity shock. In December 2021, when the cost of natural gas in Rotterdam sniffed the stratosphere at €183/MWh, the cost of grey hydrogen production was almost three times that of green hydrogen under relatively moderate assumptions (€40/MWh, mixed solar/wind PPA). This fossil fuel crisis has resulted in hydrogen-consuming plants being throttled and even completely shut down whilst they wait for the storm to pass.

However, if anyone thinks this is a temporary blip, they should note that at the time of writing, in February 2022, the Q1-2023 TTF gas contract is trading at €79/MWh, while even further out in the future, prices look to be roughly double those of the cheap-gas pre-corona years. The global drive to ditch coal seems to be driving gas demand in electricity generation to mitigate the intermittency of renewables. Much of this demand comes from Asia, where rising prosperity means energy consumption is growing at double the global average elsewhere, and is forecast to continue out to 2050. Therefore, gas prices are likely to remain resilient.

Another headwind for fossil hydrogen in Europe is the cost of emitting carbon, which has gone from insignificant in 2018 to over €90/tonne of CO2. EU Emissions Trading System (ETS) costs are now roughly equal to the reported cost of CO2 disposal via Rotterdam’s Porthos project, making carbon capture and storage (CCS) an economically feasible proposition for the first time. However, if blue hydrogen is going to substitute natural gas applications, about 30% more gas will be required, which means both the gas and carbon cost impacts are magnified in the LCOH. We should also consider what this 30% extra gas demand would mean for gas markets in a scenario where blue hydrogen is adopted en masse as a global emissions solution. Economics 101 tells us that the price goes up when we demand more of a good.

These cases illustrate the exposure of grey and blue hydrogen tQo commodity and carbon emissions (EU ETS) costs. Case 1 shows the impact of very high natural gas (€183/MWh) and carbon (€80/t of CO2) costs seen in Europe in December 2021. Case 2 shows the impact of very low energy (€10/MWh) and carbon (€5/t of CO2) prices, while in cases 3 and 4 the annual inflation rate to 2030 has been assumed at 4%, resulting in a €39/MWh gas price, with the ETS assumed to be €120/t of CO2 for emissions, and carbon transport and storage costs (€80/t) based on the CfD (contract for difference) reported for the Porthos project in Rotterdam.

Too many blue-hydrogen reports are based on unrealistically low gas-price assumptions as well as carbon emission and disposal costs, and these failings risk skewing the decision-making processes of policymakers. We need to be more transparent about how we are making comparisons and the range of uncertainty that we can expect.

So, I will close by relaying the following simple, slightly updated rule to readers: never ever quote a hydrogen price without the underlying energy AND carbon cost assumption. Anyone who does this is not a serious person.

About the author

Jamie Frew, PhD, MBA, has over 20 years of experience in the energy and chemical industries and advises on business development for industrial-scale, first-of-a-kind, hydrogen-based decarbonisation projects. He leads 12 TO ZERO, a consultancy that advises on using hydrogen technologies for a profitable transition to a zero-carbon energy system. 12 TO ZERO is increasingly focused on the new frontier of offshore hydrogen, a massively scalable decarbonisation solution that leverages the rapidly declining costs of renewables and the existing offshore-energy value chain.