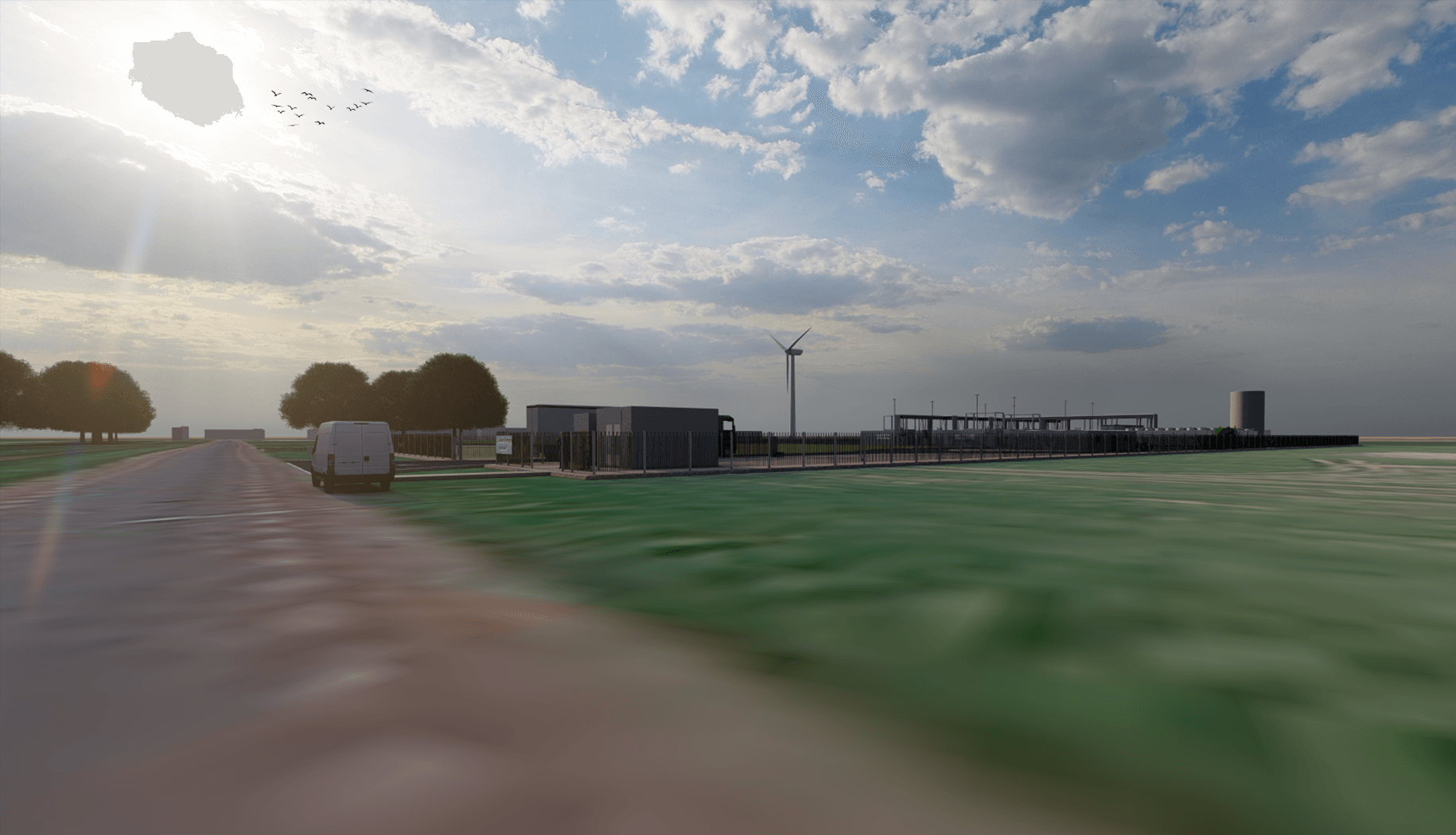

On the shores of the Western Scheldt, one of four major port areas in the Netherlands, the first large-scale electrolyser projects in the Benelux are being developed. On behalf of green hydrogen developer VoltH2, Sweco has designed and permitted two 25 MW electrolyser projects in Vlissingen and Terneuzen. At the two planned hydrogen production plants, green hydrogen will be generated with electricity from offshore wind energy and supplied to local filling stations via the integration of hydrogen storage. Due to its design, the green hydrogen factories will be expandable to 100 MW, with a potential production of approximately 15 million kg of green hydrogen per year.

In this article the lessons learned from the first projects are shared on design, permitting and project development. The projects designed by Sweco are characterized by their complex situations, in which the electrolysers are connected to other assets like solar farms or small heat plants.

Design – improving the business case

The design of hydrogen production installations starts with the idea for a total concept. Because the business case for hydrogen is still difficult to calculate, it is important to find as many sources of income as possible. The options discussed below sometimes turned out to be possible and sometimes not.

Grid congestion

Storing energy in hydrogen is particularly interesting from a development perspective if the electricity production cannot be connected to the grid. The electricity grid is overloaded in many places. There is insufficient grid capacity available in various places in the Netherlands, which means that new solar energy projects are not always connected immediately. Existing solar energy projects can also suffer from this. The transmission system operator (TSO) as well as the local distribution system operators (DSOs) are working hard to improve and upgrade the electricity grid. Yet many initiators of solar energy projects will not receive a (full) grid connection in the coming years. They have to wait even longer for that. In such cases, the production of hydrogen can be interesting to facilitate the construction of the solar park. In this way, the business case of solar and hydrogen is combined.

In addition, an electrolyser can also be used to stabilize the grid. A so-called balancing service provider (BSP) offers the grid operator balancing energy and/or balancing power. The grid operator purchases balancing power and activates balancing energy from BSPs to eliminate unforeseen imbalances in the electricity grid. This allows additional income to be generated by turning the electrolyser on or off at desired times. The electrolyser as such becomes a flexible load within the grid.

Heat demand

The efficiency of hydrogen production is a disadvantage, as is the production of electricity with coal or gas-fired power stations. However, the residual heat that is released can be put to good use in local heat networks. This is applied in some projects, provided that there are sufficient heat consumers in the area. With this, the business case can be significantly improved, as well as the sustainability of the project because the excess heat is used efficiently. The disadvantage of many hydrogen production projects is that electrolysers are usually not built next to densely populated areas. As a result, some port areas lack the necessary customers, which means that the heat cannot be used effectively.

Oxygen

Permitting – the legal framework

With the ambition of the Dutch government for large amounts of green hydrogen production, a lot of permit applications would be expected. However, since the end of 2021 only the VoltH2 projects have received an environmental and building permit. For the competent authority that needs to assess the permit application this is therefore also relatively new. A ‘hydrogen plant’ or an ‘electrolyser’ is not yet imbedded in the current environmental legislation. There is also a small chance that you will encounter these activities in a zoning plan.

Legal framework

In the Netherlands, an establishment for the production of hydrogen is subject to a license. There is a (form-free) environmental impact assessment (EIA) obligation (provided the installation remains below the threshold value). A notification memorandum must be drawn up, on the basis of which the competent authority can determine whether there are (potential) significant adverse environmental consequences. Electrolysers do not fall under the BEVI or BRZO decree. The Provincial Executive is the competent authority. On the basis of Annex I, article 4.2 of the European Industrial Emissions Directive, a hydrogen plant is an IPPC (Integrated Pollution Prevention and Control) installation.

Permit VoltH2

Looking into the design permit for VoltH2, published on 22 September 2021, the hydrogen plant has hardly any significant environmental impact (other than noise from fans). The license mainly contains the usual provisions. It is striking, however, that PGS 35 (for hydrogen delivery installations) is applied ‘analogously’ to ensure that the hydrogen storage installation complies with BAT (Best Available Techniques).

No Wnb (Dutch Nature Conservation Act) permit is required. A quantitative risk analysis (QRA) has been made as if it were a BEVI facility. The QRA shows that the 10-6 site-specific risk contour lies outside the establishment. Since hydrogen gas is a combustible gas and production takes place under high pressure, this is not illogical. Safety is of course paramount.

There are no emissions of substances of very high concern. The emission of (in short) particulate matter does not make a significant contribution. The oxygen released during the production of 1,800 tons of hydrogen is ‘released’ into the atmosphere. It is a pity that no useful application has been found for this. Also, for the released heat no end users seem to be in the picture.

The environmental permit (construction) is tested against the building and usage rules of the zoning plan. If there is a business destination with a ‘State of Business List’, then the hydrogen plant in principle falls under the category of chemical plants, inorganic substances category 4.2 (standard distance: 300 meters due to noise) or under the category ‘other gases factory, explosive’, category 5.1 (standard distance: 500 meters due to noise).

Project development – the main risks

Project development is a risky business. For the substantial investments required for hydrogen production, we currently see three main investment risks: increased costs, uncertainty of the business case, and development risks.

Increased costs

Over the last 10 years, costs in the renewable energy sector have been constantly decreasing. However, recent macro-economic shifts and political tensions are causing costs to rise. For the time being, there is no prospect of this changing. Higher prices for products like steel and iridium also make the development of hydrogen production more expensive. For many projects, rising wage costs are also a significant component, driven further by the growing shortage of personnel to carry out the work.

Rising energy costs are a driver for many to quickly switch to alternative energy sources. But not everyone has the capacity to invest, especially now that interest rates are rising and the cost of capital is increasing. Besides being an opportunity, the high costs of fossil energy are therefore also a risk. For some time now, the active policy of many governments has focused on discouraging fossil energy use by setting prices. As a result, fossil energy users have less budget to invest in, for example, PV panels or to convert their installation to use hydrogen as an energy source.

Business case

A second risk concerns the uncertain business case for energy storage. The market needs the right price incentives. At the moment, it can still be the case that charging your car at night is cheaper than during the day, while charging when the sun is shining is the best time for the system. The government needs to play a guiding role here to support the best system solution. There are sufficient policy instruments for the production of sustainable energy, of which the SDE++ is the best known. This provides a guaranteed business case at a time when market prices for renewable energy are too low. No such instrument exists for energy storage, which means that the business case has a greater risk if revenues are disappointing.

The complexity of the energy storage market is also a risk, especially for incoming cash flows, which are difficult to predict. In addition to buying at a low price and selling at a higher price, there are other revenue models. These include reducing grid connections, providing grid balancing or congestion management services, and providing back-up/emergency power services. It is important to stack these models cleverly in order to be able to draw up a balanced business case.

Development risks

Finally, energy storage projects are subject to the ‘normal’ development risks. These include the risks of whether or not to obtain a permit, but also agreements with energy companies regarding the connection to local energy networks. With regard to the technological risk, investors naturally look at the core technology of the storage method. In the case of hydrogen, this concerns the electrolyser. The preference is usually for proven technology. This does not always benefit the transition because promising new technologies are then applied less quickly and less frequently.

Although not directly related to the technology in question, the risks associated with the construction and/or operation of the storage facility are also important. These are mainly risks related to construction planning and budget control. Ultimately, this risk revolves around the question of whether the frequency of maintenance – and the associated budget – is appropriate to the technological specifications of the storage system. If more maintenance is required due to quality issues, this will have a direct impact on cash flows. The same applies to cost overruns due to insufficient budgets. It is therefore important to have a clear picture of the entire lifecycle of the project and to apply a healthy risk margin in terms of time and money. And it is precisely this aspect that is not always clear with new, unproven technologies. Here too, combining generation and storage forms can offer a solution so that the risk of innovative forms can be covered by proven technologies.