Innovation needs strength

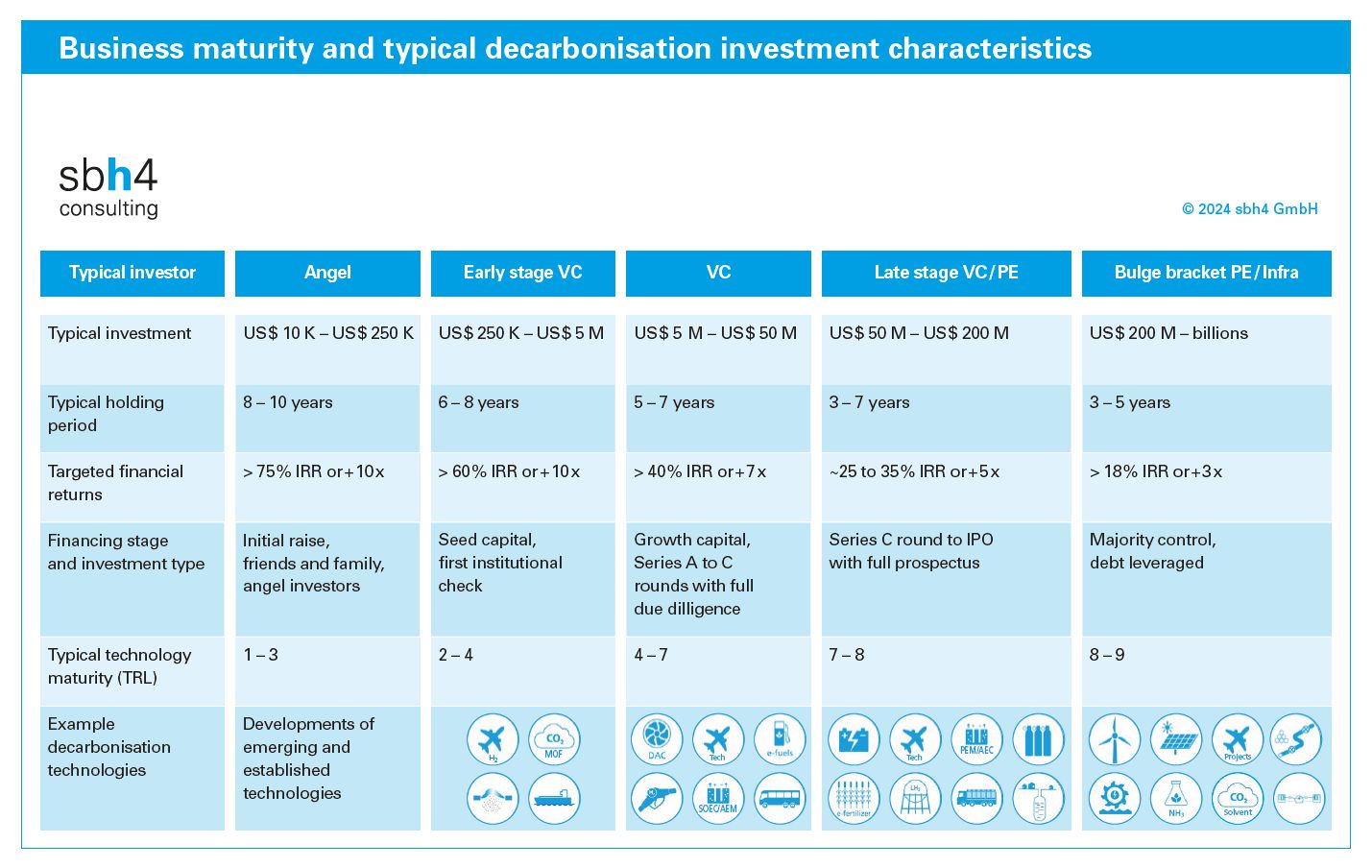

Finance for speculative innovation in the electrolyser value chain will become scarce and increasingly expensive. The wave of buy-side Venture Capital (VC) investor interest from the past five years is likely to shift to Private Equity (PE) consolidation plays and other value-seeking deals.

The next wave of high-value green hydrogen electrolyser transactions will optimise the value of what has been achieved over the past 10 years and leverage aspects that are currently being commercialised.

This is precisely what the sector needs. There will inevitably be rising costs of innovation as electrolyser technologies mature, because developments will need to be proven at an ever-larger scale to demonstrate long-term competitiveness and bankability.

Also, the cost of growth capital in this space will increase due to higher perceived risk and a more realistic expectation of returns. Interest rates being higher now than at the turn of the decade during the hype years of green hydrogen will also thin out the field.

Fewer, bigger electrolyser value chain players with strong backing are essential for the next phase of hydrogen electrolyser innovation. Only the premium players and the greatest ideas will prevail.

Convergence

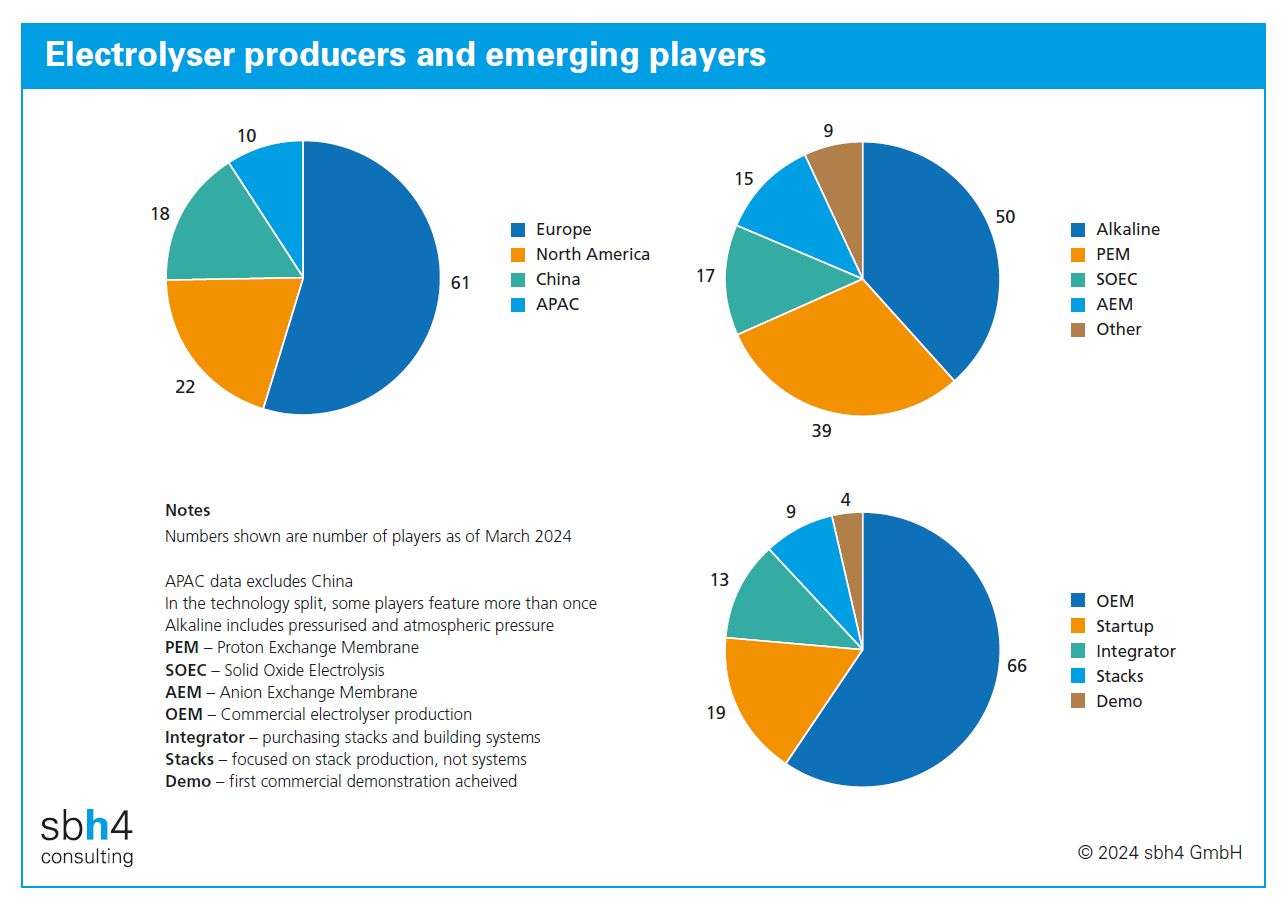

Many of the more than 100 stack builders, electrolyser system OEMs, and systems integrators will begin to merge or acquire each other. This is nothing new for the sector. Plug Power acquired Giner for more than $60 million in 2020. Sunfire acquired alkaline electrolyser technology from IHT in 2021.

Others may collaborate to pool resources and share development budgets, as Industrie De Nora and thyssenkrupp Industrial Solutions have done since 2001. This partnership has continued through the 2022 IPO of thyssenkrupp nucera.

More and more players will fall by the wayside, just as AquaHydrex filed for bankruptcy and discontinued its alkaline electrolyser R&D efforts in October of 2023. After spending millions of dollars in investment equity, in the end, only a handful of dollars were offered for AquaHydrex’s IP and R&D equipment.

Tigers ready to pounce

Nel acquired Proton Energy Systems in 2017 to form what was, at that time, the world’s largest electrolyser producer. The acquisition also meant that both PEM and alkaline electrolysers were available from one provider.

Recently, the tide has turned. Nel has announced a halt in stack production at its recently modernised production facility in Herøya, Norway. The most recent capacity upgrade at that location came online in 2024. The site boasts an electrode plating line and highly automated production of its atmospheric pressure alkaline electrolyser stacks.

Furthermore, Cavendish (the hydrogen mobility specialist spin-off from Nel) has also recently required a capital injection from Nel. Their declared focus now is on cash preservation and maintaining a technological edge for when the market picks up. Well, that’s if it does pick up and they are regarded as a serious competitor when it does.

On the other hand, the development of Nel’s (yet-to-be-launched) pressurised alkaline product range appears to continue unabated. Is this an admission that Nel’s atmospheric alkaline product range, and the Herøya factory that was refurbished around it, was always an outdated product with a stillborn growth strategy?

Will Nel be the first big name to fall victim to a ‘buy and break’ PE play? Will their PEM, atmospheric alkaline, and new pressurised alkaline divisions be broken up? Will some product lines and production assets be wound down and others sold in different directions?

Is Nel ripe for a takeover by a competitor at a bargain price? Will Nel struggle on and ultimately lay itself at the mercy of the insolvency court?

Or will the green hydrogen market suddenly pick up and pull for all the available capacity? It seems unlikely. Like Cavendish, Nel seems to be following a similar strategy of cash preservation and innovation to maintain technological relevance.

The cash crunch

Start-ups rarely buy other rival start-ups. Cultural differences, potential power struggles, and a lack of cash are obstacles to this incestuous form of consolidation.

Smaller players are more likely to be consumed by cash-rich players. Those leaning on helpful parent companies, which have diversified revenue streams and deep wallets (e.g., Fortescue Zero, Siemens Energy, thyssenkrupp nucera), will have the upper hand as M&A deals come onto the table, or start-ups see that a white-knight offering a rescue package is the only way forward.

A relevant example is the investment that Longi made in HydrogenPro in 2024. Longi is an established solar panel producer with a credible product, strong cash flow, and a profitable business model. Longi recently diversified into electrolyser production in China and has grown rapidly. In 2023, it provided 80 MW of alkaline electrolysers to Sinopec’s 260-MW Kuqa facility.

Longi’s gravitas in the renewable energy space means it can afford to invest for the long term without the need for an acquired business to demonstrate synergy overnight.

Doubling down

Strategic investors with a history of smart involvement in this space have the opportunity to both use electrolysers and benefit from selling them to third parties. They may choose to double down on some of their favourite investments and bring them in-house. For example, Mitsubishi Heavy Industries joined Longi and Andritz in Hydrogen Pro’s recent investment round.

Chart Industries, Larsen and Toubro, and McPhy have a three-way agreement. McPhy brings the electrolyser technology, Larsen and Toubro is a leading Indian EPC house with access to extensive manufacturing facilities, and Chart seeks to future-proof its business model with access to clean tech that will support decarbonisation across multiple sectors. Will McPhy end up in the portfolio of one of these two larger actors?

Posco, a major South Korean steel maker, is a major investor in Hysata, one of Australia’s leading electrolyser start-ups. Hysata, of all the green hydrogen technology innovators, undoubtedly has the greatest claim to be a mould-breaking pioneer with its bubble-free alkaline electrolyser.

Its unparalleled high efficiency results in stunningly low operating costs, and its innovative design eliminates the need for many balance-of-plant items, reducing on-site installation complexity and equipment manufacturing costs.

Posco may be proud to have the chance to leverage this kind of technology for green steel production and to support the scale-up of electrolyser production to decarbonise other sectors.

Bricks in the wall

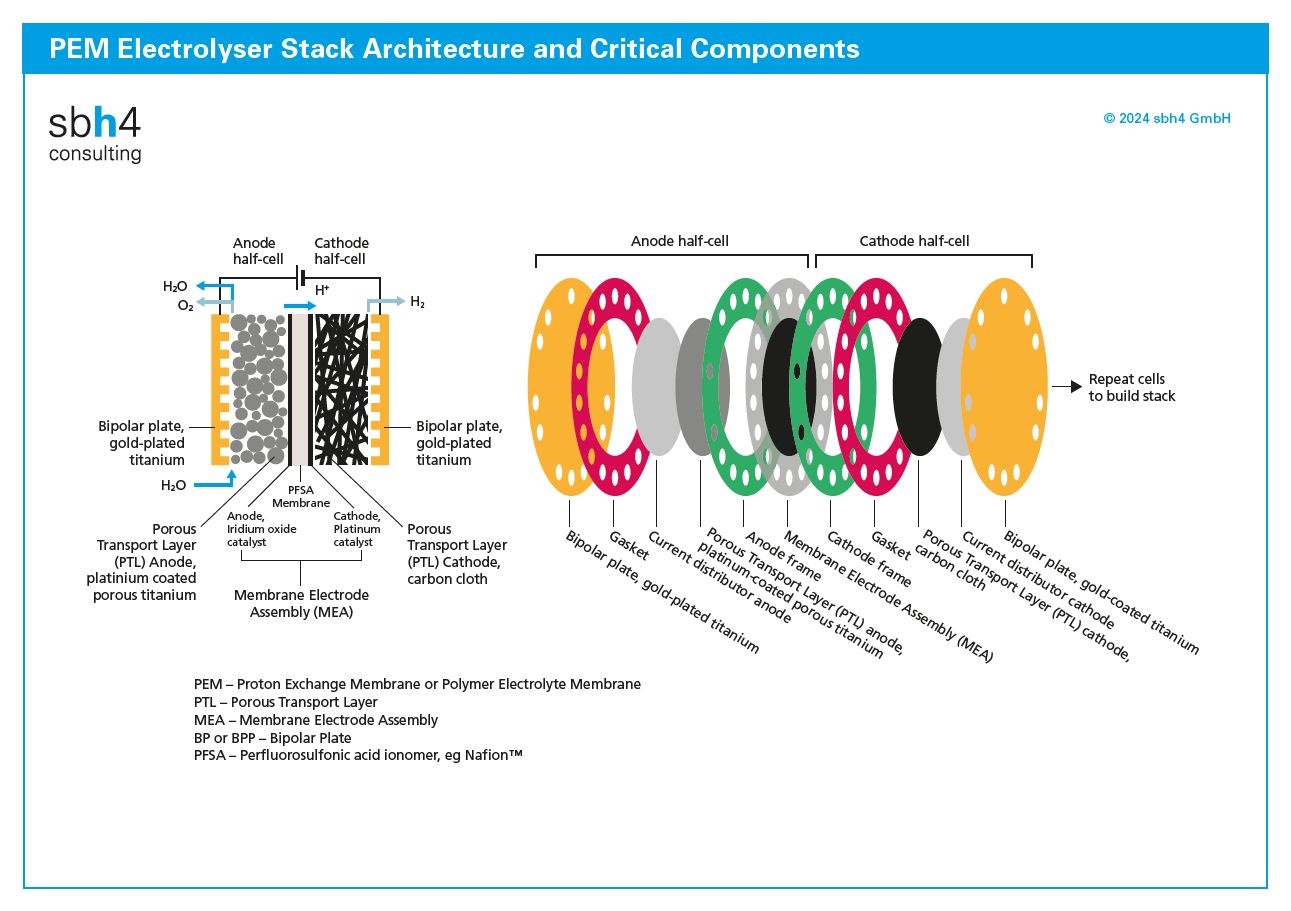

There is no single silver bullet behind Electric Hydrogen’s ultra-high-current-density PEM stack. Its innovation is breaking the PEM paradigm and challenging PEM’s reputation as an expensive electrolyser technology choice.

Its breakthrough has come from integrating a number of smart, synergistic innovations at the component level. As a result, the stack and the associated system are more cost-effective. But its magic was to look at the components and build up.

Similar things can be said about Fortescue Zero’s rectangular pressurised alkaline stack. This design breaks the trend for this class of electrolysers, which has historically used round stacks. As with Electric Hydrogen’s case, the high current density of Fortescue Zero’s stack (which leads to its small size) is achieved through cumulative component-level innovations.

Whilst these three players are all working on compelling ideas, there is no guarantee that their innovative technologies, which remain unproven at commercially relevant scale with external customers, will enjoy market success. Investment in demonstration projects may be required, and at the 50-MW scale, this comes with a heavy price tag that only the bigger players can afford.

If investor funding or parent company patience runs out before big orders are signed, these emerging product lines may be cut, or the innovations sold off for others to deploy.

Components are key

Outside of mould-breakers such as Hysata, it is becoming increasingly difficult to identify clear points of difference between KPI performance metrics for many of the ‘standard’ players. Some of the essential KPIs are efficiency, stack life, minimum turn-down, and permissible number of ‘offs’. This technological convergence is especially true when looking at pressurised PEM and pressurised alkaline stacks and systems.

For the few electrolyser builders that will survive, innovative critical components will be in high demand. These will be the differentiators that lead to stack builders having a unique selling proposition.

To ensure stack builders and electrolyser system OEMs continue to stand out in the long term, they may wish to acquire critical component manufacturers that can make a genuine difference to their market offer. Or they may seek to bring emerging component-level technologies in-house through an exclusive licensing agreement to strengthen their competitive position.

Many critical components for electrolysers are based on products that are also relevant to other sectors. For example, woven, knitted, and sintered meshes are used for filters in the automotive and chemical sectors in addition to being used as components in electrolyser stacks.

The tail may therefore begin to wag the dog, with leading critical component manufacturers that enjoy a strong and diverse revenue stream acquiring electrolyser stack builders to add value to their components.

Manufacturing makes the difference

Producers of high-tech manufacturing equipment spanning multiple sectors may take over start-ups that have entered their field. For example, builders of ALD coating machines for the semiconductor industry may take on similar technology providers working on electrolyser electrode ALD coating equipment, such as SparkNano.

Close to this concept is the Swedish company Smoltek, which has a track record in carbon nanofibre expertise in the semiconductor industry. This technology is now being applied to coat porous transport layers (PTLs) with electrode catalysts to develop innovative PTEs (porous transport electrodes).

Established players with a broad range of sector coverage will have sufficient resources and cash from other business units to drive consolidation in the electrolyser component space.

Leveraging manufacturing expertise, notably in the automotive sector, is an established entry route for stack builders. Schaeffler, Bosch, and ElringKlinger are notable examples.

Or, we may see players with decades of customised and standardised product manufacturing for the automotive industry take a deeper position with their partners. The relationship between Purem and Topsoe for high-temperature solid oxide electrolyser assembly is a case in point.

Going shopping

Capitalising on the next wave of hydrogen opportunities will be more of a value play than a growth play. The VC era is over; those heady valuations based on hockey-stick green hydrogen growth are gone.

Looking for special situations where some key components of value can be salvaged from the wreckage may be a relevant buy-side strategy to follow.

Engaging with potential partners to let them know the olive branch is there if and when they need it will also be prudent.

It might appear that there is less risk in investing in this area than there was three years ago. Valuations in this market are more realistic than they were when multiples were in the thousands or loss-making entities were being valued for hundreds of millions of dollars.

When deals come, valuations may largely be influenced by competitive bidding, with the price based on the strategic value of the jewel in the target’s crown rather than a bottom-up valuation of the entire entity based on its revenue projections.

Despite current valuations of players in the hydrogen electrolyser value chain being lower than they were some years ago, no investor ought to take the risk of buying assets that are likely to decay their value to zero. Due diligence, adherence to compliance rules, and prudence will remain the order of the day.

Exits and hopes for start-ups

The start-up CEO’s hopes and dreams may come true. Perhaps customers will arrive, and orders will eventually begin to flow. Perhaps this next R&D investment will yield the killer product. Perhaps electrolyser build projects awaiting FID will come to fruition.

This must be the bottom. Things can only get better from here, right? Perhaps not.

For proactive sellers – the start-ups looking to exit whilst the going is good or those running out of capital – there are actions they can take to hedge against the risk of being left with nothing. Or worse, being left with a heavy burden of debt.

When all was going well, there was a pitch-deck at the ready to show to potential investors. Now that there is a more nervous green hydrogen backdrop, a deck still needs to be at the ready. Different messages, different target audiences, different terms. But being realistic and being prepared will mean that start-up CEOs are likely to have some kind of leverage if the axe begins to fall.

Talking to potential future partners now, whilst things are still going well, will be a wise investment of the CEO’s time. After all, their primary role is to increase the value, or at least preserve the ongoing viability, of the entity they lead.

Or, they may wish to align with an ambitious investor, playing the consolidation game from the driving seat. Do to others what they might have done to you. Who knows, the start-up CEO may find themselves elevated from founder to the leader of a major green hydrogen electrolyser group overnight.

About the author