Introduction

2024 was a very eventful year for the hydrogen electrolyzer market, a year undeniably headlined by (1) news of high-profile hydrogen project cancellations, (2) premonitions of the impending consolidation of electrolyzer manufacturer businesses (amidst a widely reported state of production overcapacity), and (3) political winds of change that have reinvigorated debate on the green energy transition itself.

In response, some have declared such market developments to be entirely expected – consequences of an inevitable maturation phase for the hydrogen industry. Readily infused with Darwinian language of the ‘survival of the fittest’, 2025 is commonly regarded as a year where there is now a laser focus on not only commercial deployments (hydrogen projects are still moving forward, and new orders for 2025 are being declared) but also the supporting commercial strategies and financial residence of hydrogen electrolyzer vendors across the board.

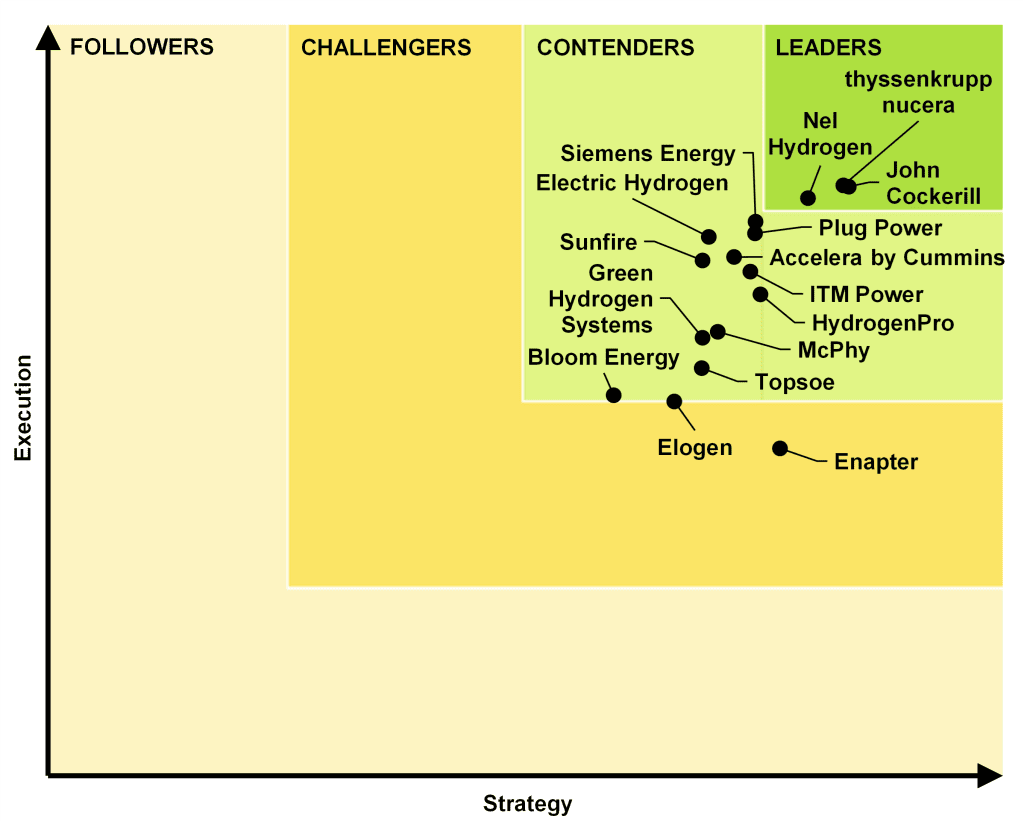

Guidehouse Insights publishes a number of different Leaderboard rankings across various decarbonisation technologies. This article reflects on Guidehouse Insights’ Hydrogen Electrolyzer Leaderboard, the latest edition having been published in Q4 2024. The Leaderboard ranked 16 of the most prominent European and North American electrolyzer vendors across eight broad metrics linked to company strategy and execution. How OEMs will adapt to the current test of resilience will be high on the industry’s agenda, and the Guidehouse Insights Leaderboard may help indicate which actors are best placed to do so. The Leaderboard is intended to help market participants better understand their competitive landscape, differentiating factors, and track records in their respective industries.

Results overview

The current vendor landscape comprises legacy players with decades of experience in electrolyzer or fuel cell manufacturing, industrial players with established businesses in other energy technology verticals, and newer companies with novel technology offerings and business models. The scope of services offered by these companies varies substantially, from dedicated stack suppliers to end-to-end players with advanced integration and engineering, procurement, and construction (EPC) capabilities. Guidehouse Insights scored the vendors in this report according to four categories: Leaders, Contenders, Challengers, and Followers.

Leaders

Leaders are companies that have differentiated themselves from the competition through exceptional product performance, strong partnerships, and a sustainable business model. Leaders are in the strongest position for long-term success in the market.

Contenders

Contenders are companies that have a solid foundation for growth and long-term success but have not attained a superior position in the market. Generally, they are well positioned to become Leaders but have not yet fully executed their product launches, need to differentiate themselves (through a tailored service offering, technology platform, or cost breakthroughs), are seeing weaker-than-expected demand, or have limited market penetration.

Challengers

Challengers, although fundamentally sound, face significant challenges stemming from a lack of strategic vision or investments, or face risks to successful execution. Challengers may also be early in their arc of electrolyzer technology launch, resulting in execution scores that are based on small numbers of deployments or capabilities.

Contenders

Followers are companies not expected to challenge the Leaders unless they can substantially alter their strategic vision and expand their resources. Their long-term viability is in doubt unless systemic changes are made within the organization. No vendors are ranked as Followers in this Guidehouse Insights Leaderboard.

What is becoming explicitly evident is that the pipeline of hydrogen production projects in advanced stages of commercial development, firm purchase orders, and data related to financial performance are all highly likely to become matters of scrutiny given the current headwinds faced in the sector.

Adapting to industrial change

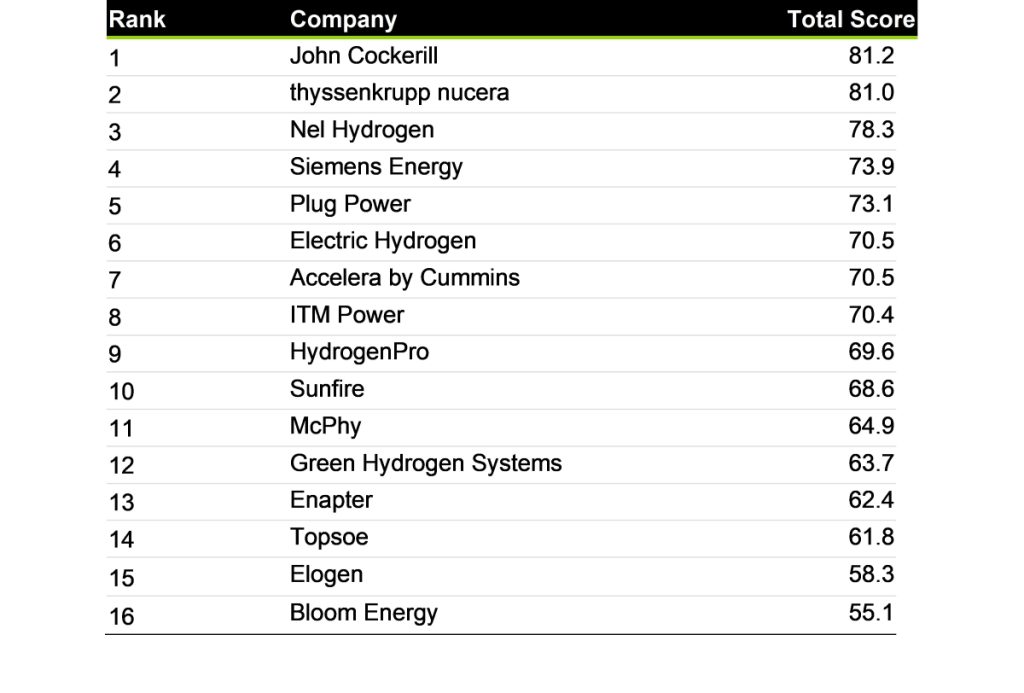

The overall rankings for the Hydrogen Electrolyzer Leaderboard are presented in Chart 2. The Guidehouse Leaderboard provides a snapshot ranking of electrolyzer manufacturers based on their cumulative strengths across both market strategy and commercial execution. A holistic view of an OEM’s strengths and weaknesses is arguably more informative than a focus on certain performance metrics that, as electrolyzer technologies continue to develop, may show reduced levels of differentiation.

Moreover, in a period of time for the industry where the emphasis will likely now lie on project execution rather than mere announcements, real-world project execution should be emphasised in any company ranking or benchmarking service. Still, a company’s strategy will inevitably be mutually imbricated with its success in commercial execution, which underscores again the need for a holistic assessment. That is why the Hydrogen Electrolyzer Leaderboard has sought to distil insights from the industry into eight quantifiable metrics that generally speak to a hydrogen electrolyzer provider’s market strategy, and market execution: qualitative strategy as well as quantitative execution.

The Leaderboard was informed heavily by stakeholder interviews, supplemented with project development trends as captured in Guidehouse Insights’ Hydrogen Electrolyzer Tracker across project deployments, purchase orders, reservation or framework agreements, as well global manufacturing capacity. Guidehouse Insights made the conscious decision to focus on projects either operational or in advanced stages of commercial development because of the burgeoning volume of projects in early phases of development (i.e., planned, announced), a good volume of which would likely have come to commercial fruition.

In all cases, vendors were encouraged to verify database entries. These more straightforward metrics in the execution category assess the competitive performance of a company’s electrolyzer technology. The electrolyzer vendor’s installed electrolyzer capacity (for projects in operation and advanced commercial development), and the volume of capacity in firm purchase orders, reservation agreements, or framework agreements, combined with global manufacturing footprint, are all tracked. This was combined with stakeholder interviews and all relevant secondary information made public by vendors.

In retrospect, commercial execution is unsurprisingly one of the higher-weighted metrics in the study. Nevertheless, the Leaderboard does incorporate metrics related to a company’s strategy, the depth and breadth of its partnerships, geographical reach, technology, and product performance-related information, as well as financial stability and staying power. A range of different metrics is important to give a holistic overview of a company’s relative positioning on the Leaderboard and enable a deeper impression with regards to how an OEM may deal with the current test of resilience in the industry.

For example, the depth and quality of partnerships that an OEM has may enable it to have an advantage with stakeholders in different geographies where significant growth in green hydrogen demand is still expected. Indeed, there have already been some initial announcements regarding European firms partnering with Chinese electrolyzer manufacturers to sell the latter’s equipment in the European market.

As with all grid- or quadrant-like scoring mechanisms published at a particular cadence, the leaderboard is a snapshot in time, one that will be inevitably updated. Moreover, the weighting of the metrics established in the methodology will likely be refined in the next edition of the report in keeping with changes and challenges within the industry.

As mentioned in the preceding section, this is particularly likely with respect to financial performance and staying power, given the headwinds faced in the sector. Another factor to highlight is pricing-related information, which readers will be unsurprised to learn is something highly sought after though not readily reported in the public sphere. To this end, Guidehouse Insights is actively exploring hydrogen benchmarking services with the incorporation of hydrogen under its General Knowledge Service (GKS) platform.

This service currently offers operational cost and/or performance benchmarking information for over 10,000 fossil, wind, and hydro power generation units, with around 30 Operations and Cost (O&M)-related metrics benchmarked at the fleet, plant, unit, and system level. Guidehouse Insights is currently engaging with participants of the Q4 2024 Leaderboard, as well as green hydrogen project developers, to provide such a service.

Another challenge is the lack of transparent and comparable data on the performance and costs of electrolyzers. To mitigate this challenge, interviews with electrolyzer OEMs were conducted to gain more information on the companies’ performance track records, commercial prospects, and strategic priorities.

Finally, the Leaderboard does not directly incorporate existing or expected trends regarding hydrogen-related infrastructure (such as the availability of hydrogen transport networks). In any case, given the increased limelight on not only electrolyzer OEMs but the hydrogen industry itself, it has become imperative to focus on real-world metrics as much as possible, be it financial, commercial deployment, or policy related.

Rankings contextualised

Clearly, 2025 is shaping up to be a year of strategic review for electrolyzer manufacturers. Project delays and cancellations, in particular, will be a challenge for all OEMs, no matter where they currently sit in the Guidehouse Leaderboard grid. Some vendors that were ranked as Leaders in the latest edition of the Leaderboard have publicly acknowledged the challenging market conditions they now face.

Leaders themselves have already implemented various measures to combat prevailing headwinds. For example, from acknowledging idling electrolyzer manufacturing capacity to curtailing manufacturing production, from downsizing measures to declaring the difficulty of predicting market demand in the short to mid-term, from significant reductions in new orders, to dropping share prices – the challenges in the green hydrogen market will no doubt be felt by all.

After the Leaders, we see the Contenders. Some companies in this bracket have announced expectations of major consolidation in the industry. Some vendors currently listed toward in the Contenders section of the Leaderboard have announced immediate downsizing in Europe, as well as reduced manufacturing activity abroad.

Perhaps the greatest challenges will be faced by OEMs toward the latter end of the Leaderboard. One of the bottom performers has faced significant challenges in sales and manufacturing, with total announced electrolyzer sales among the lowest of the lot and a negligible installed capacity. These struggles highlight difficulties in securing purchase orders. The company had planned to open a gigafactory expected to be operational by the end of 2025. However, due to ongoing market headwinds and weak order intake, construction was suspended in January 2025. The parent company indicated a shift in strategy to focus entirely on research and development, as the electrolyzer maker faces the risk of complete closure. This case underscores why the Leaderboard emphasises not only the quality of technology but also securing framework agreements and purchase orders to ensure a stable revenue stream.

Among the few manufacturers producing SOEC electrolyzers, one company had a particularly promising future, given its deep technical knowledge through its fuel cell business. Despite entering the electrolyzer space only recently, it was well positioned to capitalise on this opportunity. However, concerns over its financial stability raise questions about long-term viability.

Weaker-than-expected revenue and negative EBIT have contributed to mounting liabilities, exacerbated by a heavy reliance on debt. Additional red flags include insider stock sales and extreme share price volatility. The Leaderboard intricately evaluates staying power and places value on financial health on par with product performance to ensure the rankings reflect overall potential for growth.

A key trend among electrolyzer manufacturers has been strategic spin-offs – companies separating from their fuel cell divisions, recognising the importance of refocusing on core competencies to reduce exposure to financial and market risks associated with non-performing segments. In contrast, this company’s decision to diversify into a related but distinct product category could lead to excessive cash burn and misplaced priorities, with no guarantee of proportional returns.

The question then is: To what degree can electrolyzer vendors weather the current downturn, and will 2025 see an increased level of dispersion across the Leaderboard categories or even the replacement of some of the vendors in the top 16 list?

Conclusion

Market volatility is nothing new, especially in nascent, emerging markets such as green hydrogen. Expectations of market consolidation, slower-than-expected market demand, and manufacturing overcapacity have been voiced in the hydrogen industry before.

To what degree, then, will such challenges come to be normalised, and to what extent are we witnessing signals of a more fundamental shift in the green hydrogen landscape – perhaps even for the energy transition itself?

Going forward, momentum in FID announcements for existing hydrogen production projects is expected to increase, with a greater emphasis on commercial execution for hydrogen electrolyzer vendors rather than on planned projects or those in earlier stages of commercial development.

Perhaps, as part of what may be accepted as an inevitable maturation phase of the green hydrogen landscape, there will be a realignment of expectations regarding hydrogen’s role in decarbonisation efforts. For example, in the United Kingdom, the Climate Change Committee (CCC) recently argued that hydrogen would play a ‘small but important role’ in its Net Zero by 2050 pathway.

In the EU, the much-anticipated Clean Industrial Deal reaffirmed the EU’s commitment to reduce net greenhouse gas emissions by 90% by 2040, with a focus on energy-intensive industries and the cleantech sector. Specific hydrogen-related measures include a third European Hydrogen Bank auction, support for domestic manufacturing, and an assessment of renewable fuels of non-biological origin (RFNBO) criteria.

Amidst all this, the Guidehouse Insights Leaderboard will continue to track the relative positioning of the top electrolyzer vendors, adapting its scope and methodology as the evolves.

Disclaimer

© 2025 Guidehouse Inc. All rights reserved. This content is for general information purposes only and should not be used as a substitute for consultation with professional advisors.