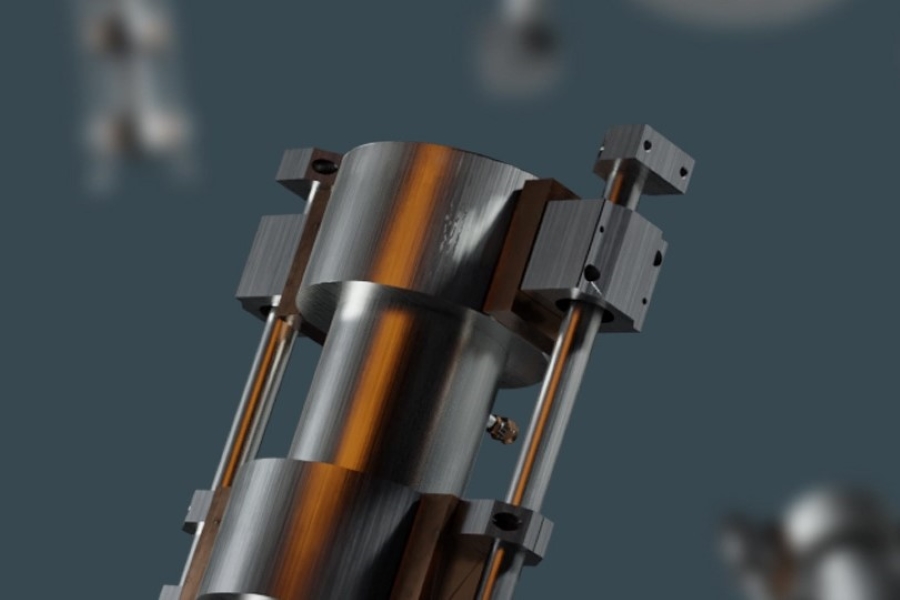

This funding aims to support the scaling of Supercritical’s proprietary electrolyser technology to pilot scale in collaboration with industry partners. The technology is designed to produce green hydrogen at high pressures, exceeding 220 bar, with an energy consumption of 42 kWh per kilogram of hydrogen. This approach seeks to reduce operational costs and address industry challenges by offering scalable solutions without the use of per- and polyfluoroalkyl substances (PFAS), membranes, iridium, or rare earth metals.

The investment round also included participation from existing investors Lowercarbon Capital and Anglo American Platinum, along with new investors such as Al Mada Ventures, Blackfinch Ventures, Kibo Invest, Niterra (formerly NGK Spark Plug Co., Ltd.), Global Brain, TOP Ventures (Thai Oil), Earth Ventures, and Alumni Ventures. The involvement of Shell Ventures and Toyota Ventures brings additional expertise and resources to support Supercritical’s global scaling ambitions.

Ethan Sohn, Principal at Toyota Ventures, commented on the potential of Supercritical’s technology: “Supercritical Solutions’ unique membraneless electrolyzer has the potential for groundbreaking energy efficiency that is critical to bringing down the levelized cost of hydrogen.”

Omar Laalej, Managing Director at Al Mada Ventures, also expressed optimism: “Supercritical’s breakthrough electrolyzer technology represents a step-change in green hydrogen production, offering a scalable and cost-effective solution to accelerate the global energy transition.”

Having already secured several key commercial commitments, Supercritical has opened a waiting list for its technology. The company aims to deliver sustainable and cost-effective decarbonization solutions for major chemical and fuel producers, positioning itself at the forefront of the green hydrogen sector.